Copyright © 2012, William Weiland

When you add products to your store via flat file import or manually one by one, you assign the product as taxable or not. However, if you are using the European or Generic VAT tax modules you have to go another step further before the the VAT tax is applied. You have to go to the product edit screen for each product which you want to tax and set the rate for that product. This module let's you eliminate the extra step. As products are added to the store, it checks the taxable setting. Then it goes to this module's database and applies the rate that you set for taxable and non-taxable. Most stores will set 0 for the non-taxable, but you could actually set a different rate. So you might have 16% for taxable and 7% for non-taxable.

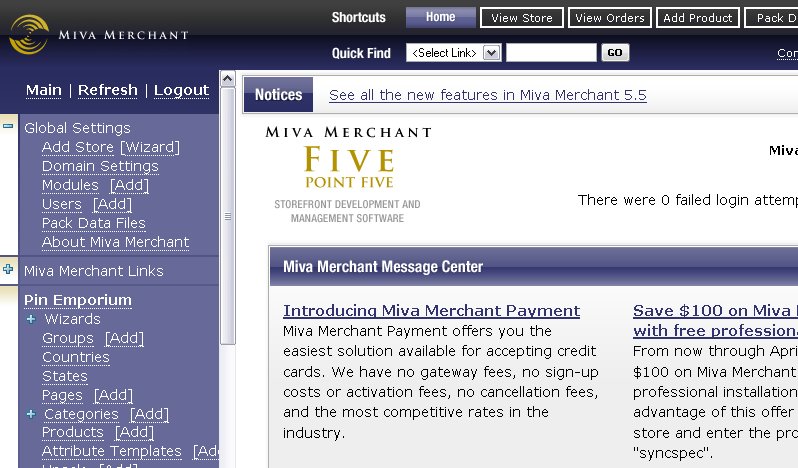

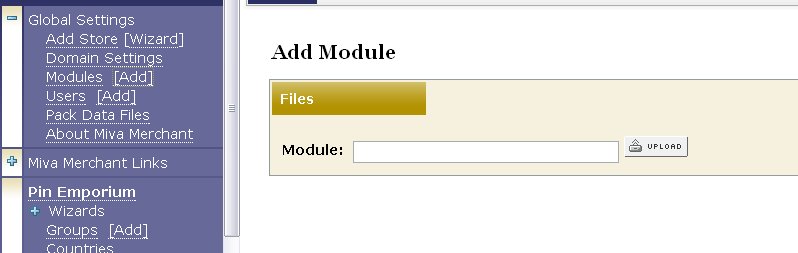

1) In admin, click Add Modules link (fig 2)

2) Click the file upload button

3) Browse to find the taxautovat.mvc file on your hard drive and upload (fig 3)

4) Click Add to add it to the domain

5) Then in admin click on the plus to the left of Stores or skip if the store's menu is already visible

6) Click the plus to the left of your store name or skip if the store's menu is already visible

7) Click on the word Utilities under your store (fig 4)

8) Check the box next to the Tax Auto VAT

9) Click Update

Configure the module

10) In the utility configuration screen, set the rate for taxable and non-taxable.

With flat file import, Miva defaults to taxable if there is nothing in a taxable column. That makes sense because most products are taxable. Therefore, the module makes the assumption that you wanted the taxable rate for VAT. If you want VAT as a non-taxable rate you will have to specify "0" in the taxable column.